Nvidia: The Stock, The Earnings, & The Hype Machine

# Nvidia's Quantum Leap: Why the Future of AI Isn't About Chips, But the Infinite Canvas They Unlock

What a week to be alive, right? I mean, seriously, if you’re not feeling that electric hum in the air, you’re just not paying attention. Jensen Huang, Nvidia’s visionary CEO, just wrapped up his GTC keynote in Washington, DC, and let me tell you, the energy wasn't just about new silicon; it was about the very fabric of our future being woven, byte by byte, right before our eyes. We're on the cusp of something truly monumental, and frankly, I find it absolutely thrilling.

When I hear people fret about a chip's lifespan, I honestly just shake my head, thinking they're looking at the wrong horizon entirely. The chatter, the whispers, the outright skepticism from folks like short seller Michael Burry – they're all focused on the trees, while the entire forest is undergoing a super bloom. Yes, Nvidia just hit a mind-boggling $5 trillion market cap last month, a feat that would've been unthinkable just a few years ago. And yes, their data center revenue has exploded from $15 billion to $115 billion since ChatGPT first blew our collective minds in late 2022. But the real story, the big idea here, isn't just about the sheer volume of chips sold or even the incredible nvidia stock price surges. It's about the accelerating rhythm of innovation itself, a beat that’s getting faster and more complex with every passing quarter.

The Unfolding Canvas of Tomorrow: Nvidia's GTC and the AI Horizon

Think about it: Nvidia is now dropping new AI chips annually, not every two years. AMD is scrambling to keep pace. This isn't just a product cycle; it's an evolutionary sprint. And some folks, bless their hearts, are wringing their hands over whether an AI GPU will last six years or five, or even three, as Amazon recently adjusted for a subset of its servers. They’re worried about depreciation, about "overinvestment." Even Microsoft CEO Satya Nadella mentioned spacing out AI chip purchases. And sure, CoreWeave’s stock took a hit due to data center delays, and Oracle shares plummeted. These are real market movements, absolutely.

But let’s be honest with ourselves for a moment. This isn't like buying a refrigerator or a server rack from the early 2000s that you expect to hum along for a decade. We’re in an entirely new paradigm. Jensen Huang himself, with that characteristic twinkle in his eye, joked back in March that "When Blackwell starts shipping in volume, you couldn’t give Hoppers away." Now, some might see that as a sign of dangerous obsolescence, a volatile market where your investment is yesterday’s news before you unbox it. I see it as a testament to the sheer, unbridled pace of human ingenuity, a relentless march forward that’s pushing the boundaries of what’s possible so quickly that yesterday's marvel becomes today's baseline. It’s not that the old chips lose value; it’s that the new capabilities they unlock are so exponentially superior, they redefine the very concept of "value."

This isn't just about silicon anymore; it's about the software, the ecosystem, the very mind of AI. Nvidia AI Enterprise (NVAIE), launched in 2021, is becoming the operating system of this new world. It’s what allows clients like Nasdaq, the IRS, and AT&T to actually build and deploy their own AI applications. Yes, internal emails from Nvidia's Worldwide Field Operations hinted at challenges in selling this enterprise software to highly regulated clients, citing a "fundamental disconnect" in understanding complex sales processes and data security. Nvidia's internal emails reveal a 'fundamental disconnect' with major software clients - Business Insider But every revolution has its growing pains, right? This isn't a flaw; it's a feedback loop, an opportunity for Nvidia to refine its approach and make its incredible software even more indispensable. The fact that software sold alongside hardware is lagging behind stand-alone sales isn't a disaster; it's a clear signal: the market is hungry for solutions, not just components.

Beyond the Hype Cycle: Where Real Value is Forged

What does this all mean for us, for the future? It means we're watching the birth of an entirely new industrial complex, an AI infrastructure that companies like Google, Oracle, and Microsoft are collectively planning to pour a trillion dollars into over the next five years. The GAIN AI Act, backed by Amazon and Microsoft, aiming to prioritize domestic AI chip orders, isn't a sign of weakness for Nvidia; it's a flashing neon sign proclaiming the strategic, almost geopolitical, importance of what they create. Amazon, Microsoft back effort to curb Nvidia's exports to China, WSJ reports - Yahoo Finance Washington is scared of China leveraging high-end AI for military purposes – that’s how critical this technology has become. This act, whether it fully passes or not, underscores the immense power embedded in these processors, making them a national resource.

This relentless pace, this exponential curve, it reminds me of the early days of the internet, when people were still trying to figure out if email was just a fad. Or perhaps even earlier, to the advent of electricity, when entire industries had to be reimagined. We are seeing a complete reshaping of how we create, how we innovate, how we even think. The speed of this is just staggering—it means the gap between today and tomorrow is closing faster than we can even comprehend, opening up possibilities for medicine, science, and everyday life that we can barely dream of right now, and it's all powered by this incredible, ever-evolving ecosystem.

Some might call it a bubble, point to Palantir stock or other market fluctuations, but I see it as the chaotic, vibrant energy of creation. When CoreWeave CEO Michael Intrator says fully booked Nvidia A100 chips from 2020 and H100 chips from 2022 are immediately re-booked at 95% of their original price after contract expiry, that tells you something profound. It tells you that the utility and demand for these tools are so immense, their value transcends simple depreciation schedules. The true value isn't just in the physical chip; it's in the constant, dynamic capability it unlocks, the new problems it can solve. We're not just buying hardware; we're buying a ticket to the future, and that ticket has a constantly upgrading seat.

The True North of Innovation

So, what's the real story? It's not about the lifespan of a single component; it's about the infinite, evolving canvas of possibility that Nvidia and the entire AI industry are painting. This isn't a static asset; it's a living, breathing, accelerating engine of progress. And for anyone still counting the years on a depreciation schedule, I'd say you're missing the forest for the trees – the future isn't depreciating, it's accelerating.

Previous Post:Chick-fil-A: Beyond the 'My Pleasure' Facade

Next Post:Bitcoin: Price Today and ETF Impact

Related Articles

ARM Stock: Analyzing the price surge and what comes next

ARM's Surge is a Warning Sign, Not a Victory Lap On Monday, the market did what it does best: it rea...

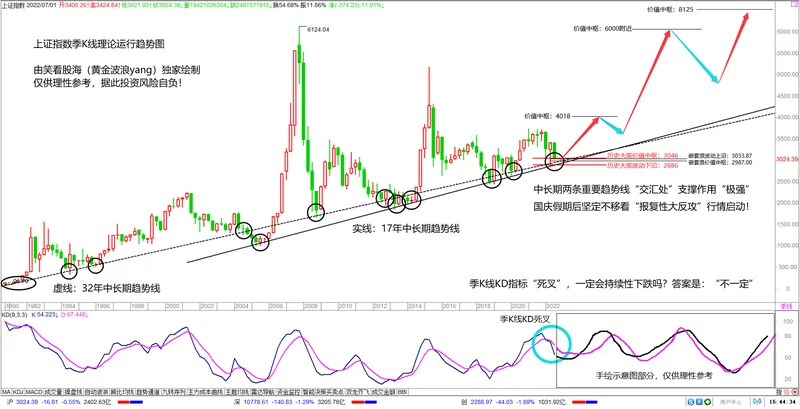

China's SSE Index Upgrade: Why This Signals a New Era for Global Tech & Finance

I spend most of my days thinking about the future. I look at breakthroughs in quantum computing, AI,...

Tesla's Troubles: Elon's Distractions vs. Sales Data

Elon's UK Meltdown: Can Tesla Survive Musk's Political Circus? Tesla's facing a serious problem in t...

AI's Free Push in India: What's the Catch?

Title: Free AI in India: Charity or Calculated Data Grab? The rush is on. Google, OpenAI, and Perple...

Julie Andrews: Why Her Legacy Endures Beyond Her Iconic Voice

I spend my days analyzing systems. I look at code, at networks, at AI, searching for the elegant des...

The 'Mad Money' Phenomenon: What Our Search for Cramer & Keaton Reveals About Us

Jim Cramer Just Dismissed the Future of Work and Flight. Here's Why He's Missing the Bigger Picture....