BMO's Expanding Universe: What's Behind the Buzz?

Title: Trupanion's $56.50 Fair Value: Are We Witnessing the Next Pet-Tech Boom?

Okay, folks, buckle up! Because I've been digging into Trupanion's latest numbers, and I'm seeing something really exciting – a potential inflection point not just for the company, but for the entire pet-tech industry. We're talking about a future where pet healthcare is not just accessible, but proactive, personalized, and powered by data. And Trupanion, with its recent record earnings, BMO partnership, and $120 million credit facility, might just be the company leading the charge.

The headline that caught my eye? "Trupanion's Latest Close of $38.58 is Notably Below the Narrative Fair Value Estimate of $56.50." Now, I know what you're thinking: analyst estimates, blah, blah, blah. But this isn't just about numbers on a spreadsheet, folks. This is about a fundamental disconnect between market perception and future potential.

I mean, think about it: we're living in an age where technology is transforming every aspect of our lives. From personalized medicine for humans to AI-powered diagnostics, the possibilities are endless. And yet, the pet healthcare industry, while growing, still feels… well, a little bit behind the curve.

The Undervalued Pet Revolution

Trupanion is trying to change that. They're not just selling pet insurance; they're building a comprehensive ecosystem of data, technology, and veterinary expertise. The BMO Insurance partnership, for instance, is a huge deal. It’s not just about expanding their reach; it's about integrating pet healthcare into the broader financial landscape, making it more accessible and affordable for pet owners. It's like when ATMs started popping up everywhere – suddenly, banking became way more convenient, right? I see the same kind of potential here.

And then there's the $120 million credit facility. This isn't just about keeping the lights on; it's about fueling growth, investing in innovation, and scaling their operations to meet the growing demand for pet healthcare. It's a bold move, and it signals a clear commitment to the future.

But here’s the thing: the market doesn’t seem to fully appreciate this yet. The stock price is down nearly 20% year-to-date, and the price-to-earnings ratio is sky-high. Why? Well, the article points to "stagnant subscriber growth and increasing competition." And sure, those are valid concerns. But I think there's something else at play here: a fundamental misunderstanding of the long-term potential of the pet-tech market.

Because let's be real: pets are family. And as pet owners, we're willing to spend more and more to ensure their health and well-being. Trupanion is tapping into that trend, and they're doing it in a way that's both innovative and sustainable. They're focusing on "higher lifetime value pets" and optimizing their acquisition channels. What does that mean? It means they're not just chasing after every pet owner; they're building a loyal customer base that will stick with them for the long haul.

And that’s where the real opportunity lies. As Trupanion continues to grow and scale, they'll be able to leverage their data and technology to provide even more personalized and proactive pet healthcare solutions. Imagine a future where AI-powered diagnostics can detect diseases early, where personalized treatment plans are tailored to each pet's unique needs, and where pet owners have access to a comprehensive suite of tools and resources to help them care for their furry friends. What if we could use predictive analytics to prevent illnesses before they even happen?

But, we have to pause here for a moment. With all this data, with all this power, comes responsibility. We must ensure that pet healthcare remains ethical, transparent, and focused on the well-being of the animals above all else. The potential for misuse is real, and we need to be vigilant in safeguarding against it.

This is the kind of breakthrough that reminds me why I got into this field in the first place. When I first saw what Trupanion was building, I honestly just sat back in my chair, speechless.

Ready to Unleash the Pet-Tech Revolution?

So, what's my take? I think Trupanion is currently undervalued, and I think it has the potential to be a major player in the pet-tech market. But more importantly, I think it's part of a larger trend: a shift towards more personalized, proactive, and data-driven healthcare for our furry friends. This isn't just about making money; it's about improving the lives of pets and their owners. And that's something we can all get excited about. According to Trupanion (TRUP): Assessing Valuation After Record Q3 Earnings, BMO Partnership, and $120M Credit Facility, Trupanion's Q3 earnings, BMO partnership and credit facility are key factors in assessing its valuation.

Related Articles

Chongqing: China's Industrial Base Aiming for Drug Breakthroughs

Generated Title: Chongqing's Pharma Dreams: More Hype Than Hope? So, Chongqing wants to be the next...

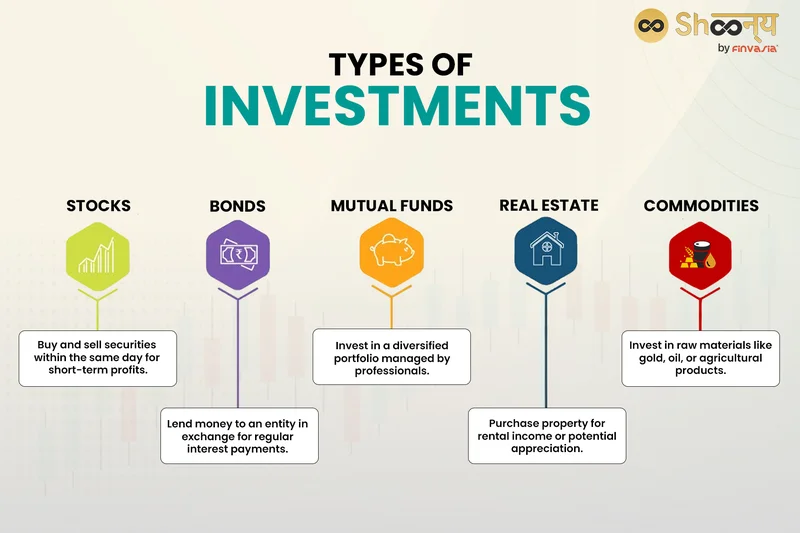

Analyzing 2025's Investment Landscape: What the Data Reveals About Top Asset Classes vs. Low-Risk Alternatives

There's a quiet, pervasive myth circulating among the baby boomer generation as they navigate retire...

npr: What is it?

How Meme Stocks Turned Wall Street Upside Down The meme stock phenomenon. It sounds like a fleeting...

AI's Free Push in India: What's the Catch?

Title: Free AI in India: Charity or Calculated Data Grab? The rush is on. Google, OpenAI, and Perple...

The VIX Name is a Complete Mess: What the Streaming Service Is vs. That Stock Market Thing

So, the market’s "fear gauge" finally decided to show a pulse. Give me a break. On Friday, the VIX s...

ARM Stock: Analyzing the price surge and what comes next

ARM's Surge is a Warning Sign, Not a Victory Lap On Monday, the market did what it does best: it rea...